22. May 2023

Crypto - pure scam and speculation or fundamental / intrinsic value attributable to it? - Crypto is "crazy, stupid, gambling, ... And people who oppose my position are idiots..." sic Charlie Munger in 2023.

In this article you learn how to distinguish crypto-scam from crypto-value, which cryptoassets and crypto tokens may carry intrinsic value and how it can be measured using fundamental value analysis methods adopted to the new world.

18. February 2023

Why is the SEC hitting PoS staking... or is it not doing that at all? Opinions actually vary, from once-off action, not to further worry, to continued boiling the water with unknowing destination - Amongst the expert opinions also my personal view on the matter

17. September 2022

The Ethereum community is still celebrating its great success with a smooth Merge transition from PoW to PoS, and thereby gaining competitive edge over other major blockchains, with fundamental ecological, security and economical benefits for the ecosystem. In that very moment, one U.S. regulator pours a big thread over the PoS powered blockchain space, particularly now Ethereum.

In this article, i summarize what is in it, and not in it the Merge, and a concrete regulatory thread

11. June 2022

Last week on July 7, Senators C. Lummis and K. Gillibrand, introduced a bill to regulate digital assets.

So what?

1) This initiative is a milestone for the U.S. crypto regulation, and to catch up internationally

2) It is bi-partisan, sponsored by 2 (woman) leaders, to increase chances of enactment

3) It has global appeal, also towards liberal states like the EU states with their MiCA project and crypto hubs Switzerland and Liechtenstein, which have already regulated the sector as first movers

07. May 2022

n March the Axie Infinity Ronin bridge was hacked and $625 million stolen, supposedly by North-Korean cyber criminals. What is special of the crypto-hack this time? Its scale, one of the biggest in history, its malicious actors, a Nation-backed criminal cyber group (Lazarus), and particularly its novel means of enforcement. In this short article, I provide the details behind and conclude, how effective crypto addresses on a sanctions list are to prevent money laundering in the DeFi space.

09. February 2022

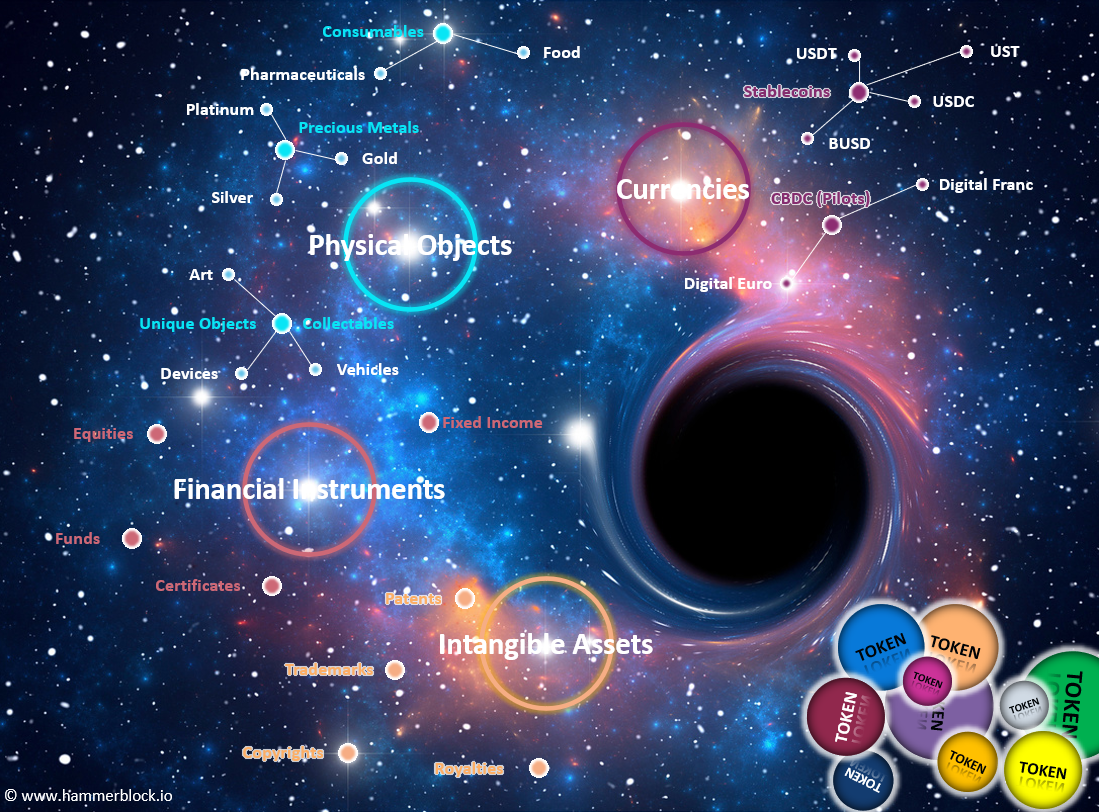

Tokenization allows virtually any real-world asset to be represented on the Blockchain. By 2027, according to a WEF estimate, 10% of global GDP will be stored on the Blockchain, around USD 9.38 trillion. The central building block for the emergence of a token economy is tokenization. This article describes what it is all about and its partly disruptive significance.

05. November 2021

This year's Christmas Day is the earliest possible formal date for the SEC to approve the first Bitcoin SPOT ETF.

Grayscale Investment CEO, Michael Sonnenheim is confident that his application to convert the flagship product Grayscale Bitcoin Trust (OTCQX: GBTC) into a Bitcoin Spot ETF will be approved by the SEC. He derives this from the agency's recent approval of various bitcoin futures ETFs.

That would indeed be a watershed moment for the entire Crypto space, if there were not the SEC ...

24. October 2021

Markus Hammer's and other market experts' views on the first Bitcoin Futures ETF issuance in the U.S. (i.e. the ProShares Bitcoin Strategy ETF (BITO)) - in an article of Andrew Singer in Cointelegraph

23. October 2021

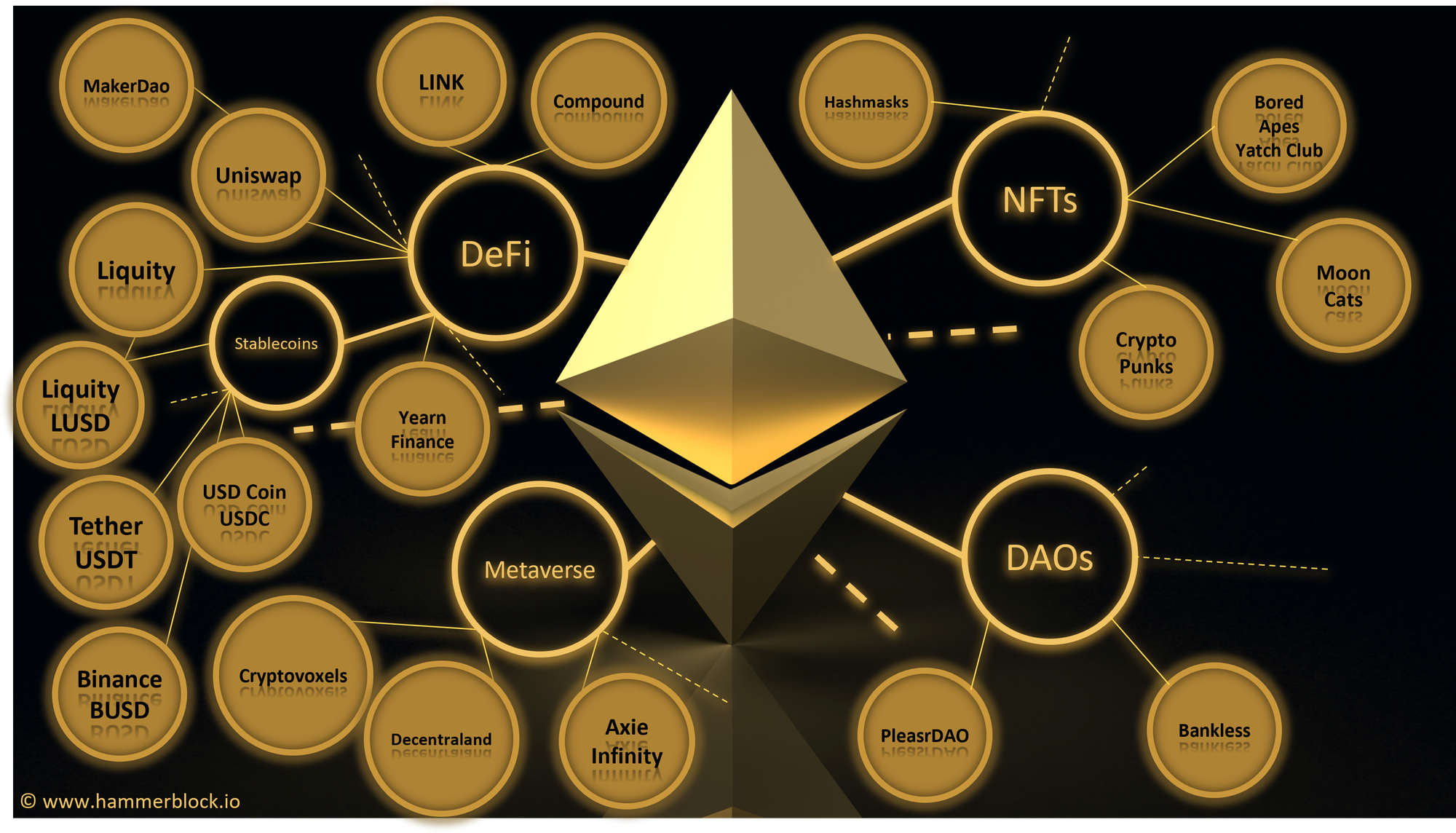

General purpose blockchains like Ethereum are more than Bitcoin as a single purpose Blockchain. The underlying network with its literally unlimited use cases generates higher value to the real world ... and longer term that will also be reflected in the valuation of the coin, despite, price correlation between BTC and ETH is still high, currently. In this article on MoreThanDigital, I will highlight the similarities and differences between the two networks and what Ethereum’s additional...

18. September 2021

Switzerland offers excellent framework conditions and ecosystems in the blockchain and crypto sector, deserves international recognition as a hub and avant-garde (see more in a previous article). One would think that everything is in place to attract crypto companies, especially startups, if it weren't for the fact that blockchain founders simply can't find banks within the country's borders to open a business account, on which every company ultimately depends. Focal point of the problem lies...

Contact / Social Media

www.hammerblock.io powered by HammerExecution

Email: markus.hammer@hammerexecution.com

LinkedIn: https://www.linkedin.com/in/hammerblock/

reddit: u/hammerblockio

twitter: @hammerblockio